Handling Mergers & Demergers

Last updated on August 14, 2025

Mergers and demergers are significant corporate restructuring events that can have complex implications for your portfolio and tax situation. Taxtallee provides tools to help you manage these events.

Definitions

- Merger: Two or more companies combine into one. As a shareholder, you might receive shares in the newly merged entity, cash, or a combination of both.

- Demerger: A company spins off a part of its business into a new, separate, publicly-listed company. As a shareholder of the original company, you typically receive shares in the new company.

CGT Rollover Relief

A key concept in these events is Capital Gains Tax (CGT) Rollover Relief. The ATO often provides guidance on whether you can "roll over" the CGT consequences.

Understanding Rollover Relief

- Rollover Applied: You can choose to defer any capital gain or loss that would normally arise from the disposal of your original shares. The cost base of your original shares is apportioned across the new shares you receive. No CGT is payable until you sell the new shares.

- No Rollover (CGT Event): The exchange of your old shares for new ones is treated as a CGT event. You must calculate a capital gain or loss for that financial year based on the market value of what you received.

You should always consult the official ATO class ruling or company documents for the specific event to understand if rollover relief is available and how to apportion the cost base.

How to Record a Merger or Demerger

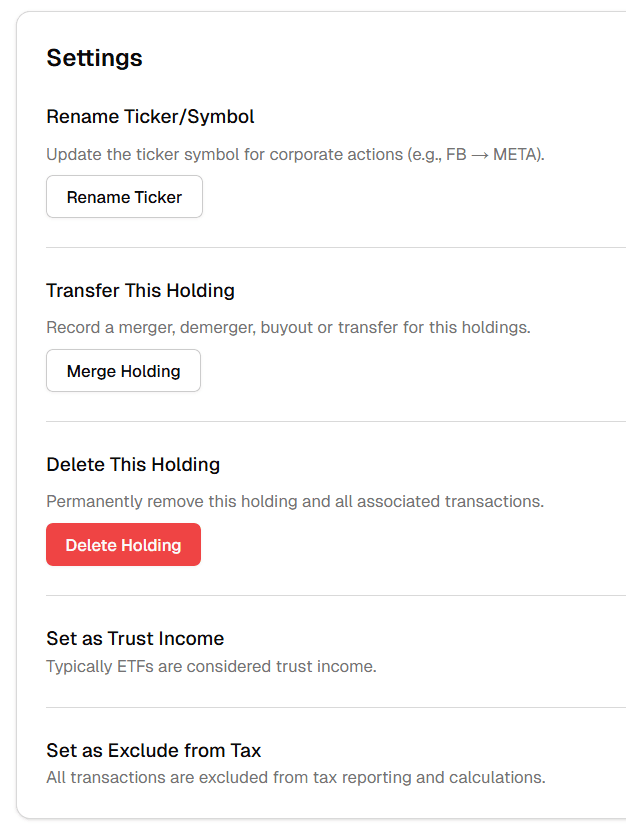

Taxtallee's "Merge Holding" feature is designed to handle scrip-for-scrip events where you exchange your old shares for new shares.

- Navigate to the page of the original holding (the one being acquired or demerging).

- Go to the Settings tab.

- Click the Merge Holding button.

In the form, you will need to specify:

- The New Ticker(s): The new company or companies you received shares in.

- Quantity Received: The number of new shares you received.

- Cost Base Apportionment: The percentage of the original cost base to be transferred to the new holding(s). This information is critical and must be obtained from the official ATO or company guidance for the event.

- Cash Received: Any cash amount you received as part of the deal.

Upon confirming, taxtallee will create the necessary disposal transaction for your old holding and a new "buy" transaction for the new holding with the correctly apportioned cost base.