Cost Base Adjustments (ROC, Capital Calls)

Last updated on August 14, 2025

A cost base adjustment is a corporate action that changes the original cost of your investment without altering the number of shares you own. Recording these events is critical for ensuring your Capital Gains Tax (CGT) is calculated correctly when you sell your shares.

Types of Cost Base Adjustments

Return of Capital (ROC)

A return of capital occurs when a company or fund returns a portion of your original investment money to you. This is not considered income or a dividend; it is a tax-free payment that reduces the cost base of your shares.

Example: You own 1,000 units of an ETF with a total cost base of $10,000 ($10 per unit). The fund announces a Return of Capital of $0.50 per unit. You receive $500 in cash. Your new cost base for the 1,000 units is now $9,500 ($9.50 per unit).

Important Note: If a return of capital reduces your cost base below zero, the excess amount is treated as a capital gain in that financial year.

Capital Call

A capital call is when a company requires its shareholders to contribute more money for the shares they already own. This is common in certain types of investments like limited partnerships or some infrastructure funds. This payment increases the cost base of your investment.

Example: You own 100 shares in an investment company with a cost base of $5,000. The company makes a capital call of $10 per share. You pay an additional $1,000. Your new cost base for the 100 shares is now $6,000.

How to Record Cost Base Adjustments

You can easily record these events in taxtallee:

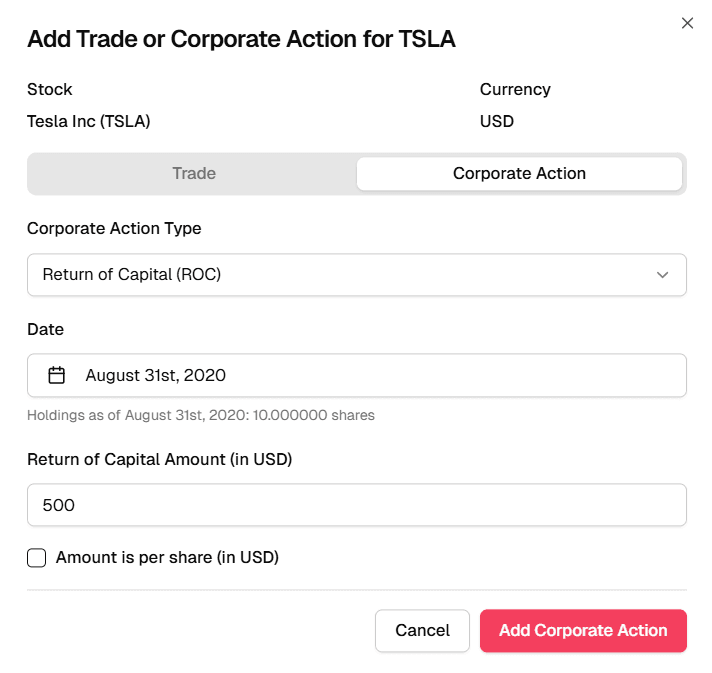

- Click the Add Entry button and select Add Corporate Action.

- Select the appropriate action type: Return of Capital (ROC) or Capital Call.

- Enter the Date of the event and the total Amount (or amount per share).

Taxtallee will automatically apply this adjustment proportionally across all your existing parcels of shares for that holding, ensuring your records are accurate for future tax calculations.