A Strategic Guide to ATO's Capital Gains Tax & how you can lower your taxes

Published on July 30, 2025 by Lee at Taxtallee

For every Australian investor, from the seasoned trader to the newcomer testing the waters, tax time brings a familiar challenge. It’s not just about tracking your dividends and trades; it’s about understanding that how you declare your capital gains can have a massive impact on your tax bill.

Managing this complexity is precisely the problem we built taxtallee to solve. We're here to demystify the process and give you the tools to move from reactive tax reporting to proactive tax optimisation.

The Hidden Complexity of Capital Gains Tax (CGT)

When you invest, you’re not just buying shares; you're acquiring parcels, or "lots," of assets. If you buy shares in the same company at different times and prices, each purchase is a separate asset with its own cost base.

This is where it gets tricky. When you sell some of those shares, the Australian Taxation Office (ATO) gives you the power to choose which parcel you’ve sold. This choice directly determines your capital gain or loss for that sale.

Don't just take our word for it. The ATO explicitly states the importance of this choice on their website:

"When you sell only some of your shares or units in a company or trust, you need to be able to identify which ones you have sold and when you acquired them. This is important because shares or units bought at different times may have different costs. This will affect your capital gain or loss."

- ATO: Keeping records of shares and units

The ATO provides an example of an investor named Boris who strategically sells a parcel of shares to claim a capital loss. This isn't a loophole; it's a fundamental part of the tax system that savvy investors use to their advantage. The catch? You must keep meticulous records.

The Power of Choice: A Tale of Two Tax Outcomes

Let's illustrate this with a simple example. Imagine an investor, Sarah, made the following trades in CBA:

Example: Sarah's Smart Sale

- January 2022: Buys 100 CBA shares at $90 each (Cost Base: $9,000).

- January 2024: Buys another 100 CBA shares at $120 each (Cost Base: $12,000).

- March 2025: Sells 100 CBA shares at $110 each (Proceeds: $11,000).

Sarah has two very different ways to declare this sale:

Scenario 1: The Standard FIFO Approach

Using the "First-In, First-Out" (FIFO) method, she sells the first parcel she bought.

$11,000 (Proceeds) - $9,000 (Cost) = $2,000 Capital Gain

Because she held the shares for over 12 months, she's eligible for the 50% CGT discount, resulting in $1,000 of taxable income.

Scenario 2: The Strategic Approach

Sarah chooses to sell the parcel she bought in 2024 to minimise her tax for the current year.

$11,000 (Proceeds) - $12,000 (Cost) = $1,000 Capital Loss

This capital loss can be used to offset other capital gains in the same year, or be carried forward to future years.

The same sale resulted in two completely different tax outcomes. This is the power you have as an investor, but wielding it requires a tool that can keep up.

Introducing taxtallee: Your Tax Strategy Companion

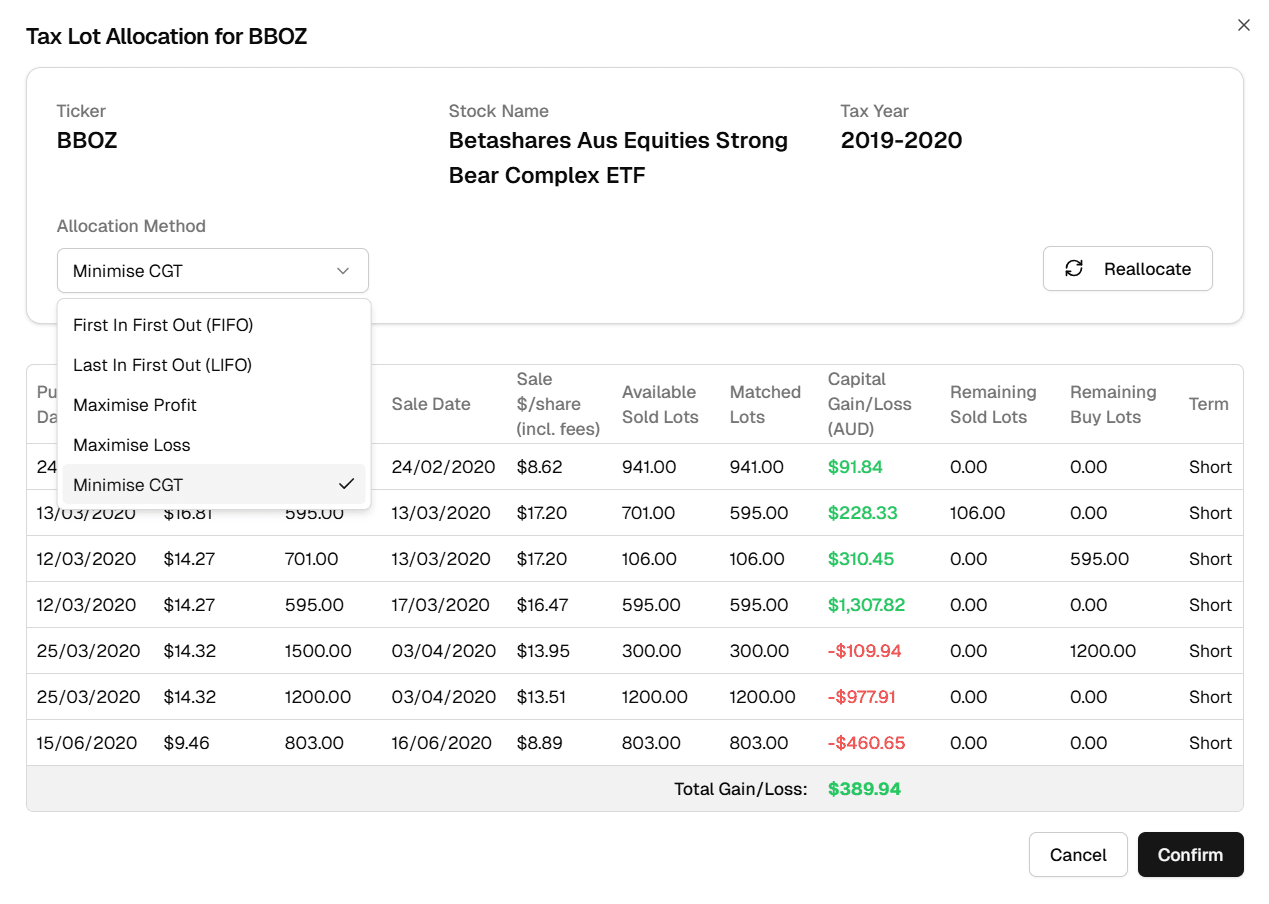

This is where taxtallee shines. We provide the framework to not only track your holdings but to model and execute these tax-saving strategies with confidence. Our Capital Gains Tax Manager gives you the flexibility to choose the most optimal allocation method for every single sale.

With taxtallee, you can apply various allocation methods:

- FIFO (First-In, First-Out): The most common method, selling your oldest shares first.

- LIFO (Last-In, First-Out): Sells your newest shares first, often useful in rising markets to realise smaller gains.

- Maximum Loss: Strategically sells lots that generate the largest capital loss to offset other gains.

- Maximum Gain: Useful for utilising carried-forward capital losses from previous years.

- Minimise CGT: The smartest approach, which intelligently considers the 50% CGT discount on long-term holdings to calculate the lowest possible tax impact.

Who is taxtallee For?

Whether you're a seasoned investor working with a tax agent or a new investor tired of wrestling with spreadsheets or just sick of expensive tools such as sharesight and are looking for an alternative, taxtallee is built for you.

- For the new investor: Say goodbye to complex Excel formulas. Upload your trades via CSV, and let us handle the intricate calculations. We provide the clarity you need to understand your portfolio's true performance and the tools needed to accurately and flexibly declare your taxes.

- For the experienced investor: Focus on the good stuff like finding that next great investment or save on the existing expensive tools. With taxtallee you can model different tax scenarios before you sell and take direct control over your financial outcomes with ease.

Our Promise: Your Data, Your Control

We heard you loud and clear, Australia. Many expensive tools can feel like they lock you in. We believe your data is yours. With taxtallee, you can easily upload your trades and dividends via CSV, and more importantly, you can export your detailed tax lot allocations at any time for your own records.

Taxtallee isn’t just a tool you use once a year. We aim to be your trusted companion throughout your entire investing journey, helping you make smarter decisions every step of the way.

Ready to take control? Stop being reactive at tax time and start building a proactive strategy today.