A 2025 Guide to The ATO's Capital Gains Tax for Stocks

Published on August 6, 2025 by Lee at Taxtallee

Capital Gains Tax (CGT) is a fundamental concept every Australian investor must understand. It’s not a separate tax but rather a component of your income tax. When you sell an asset like shares, ETFs, or property for more than you paid, the profit—or capital gain—is added to your assessable income for the year.

Navigating the rules can seem daunting, but getting it right is crucial for accurate tax reporting and, more importantly, for legally minimising the tax you pay. This guide will walk you through the essentials for the 2025 tax year, with direct references to the Australian Taxation Office (ATO) guidelines.

What is a CGT Event?

The most common CGT event for investors is the sale of shares or units in a managed fund (like an ETF). However, the ATO lists many situations that trigger a CGT event, including giving an asset away, an asset being lost or destroyed, or even stopping being an Australian resident.

According to the ATO's myTax 2025 instructions, "The most common CGT event happens when you sell or give away a CGT asset, such as: real estate... shares and similar investments, units in a unit trust or managed investment fund... crypto assets."

- ATO: myTax 2025 Capital gains or losses

For most investors, the key event is the disposal of their investments.

Calculating Your Capital Gain or Loss

The basic formula is straightforward:

Capital Proceeds - Cost Base = Capital Gain or Loss

- Capital Proceeds: This is the money you receive from the sale.

- Cost Base: This is what it cost you to acquire the asset, including the purchase price and any associated fees like brokerage.

If your proceeds are greater than your cost base, you have a capital gain. If they are less, you have a capital loss. You can't deduct a capital loss from your regular income (known as assessable income), but you can use it to reduce capital gains in the same year or carry it forward to future years.

Record Keeping: The Golden Rule of CGT

The ATO places a strong emphasis on record keeping, and for a good reason. If you buy shares in the same company at different times, each purchase is a separate CGT asset, or "parcel." When you sell some of those shares, you must be able to identify which parcel you sold.

Why Parcel Identification Matters

As the ATO states in their guide on Keeping records of shares and units, "This is important because shares or units bought at different times may have different costs. This will affect your capital gain or loss."

This choice gives you the power to influence your tax outcome, but it requires you to maintain flawless records of every transaction.

Special Considerations for Your Investments

Shares (Equities)

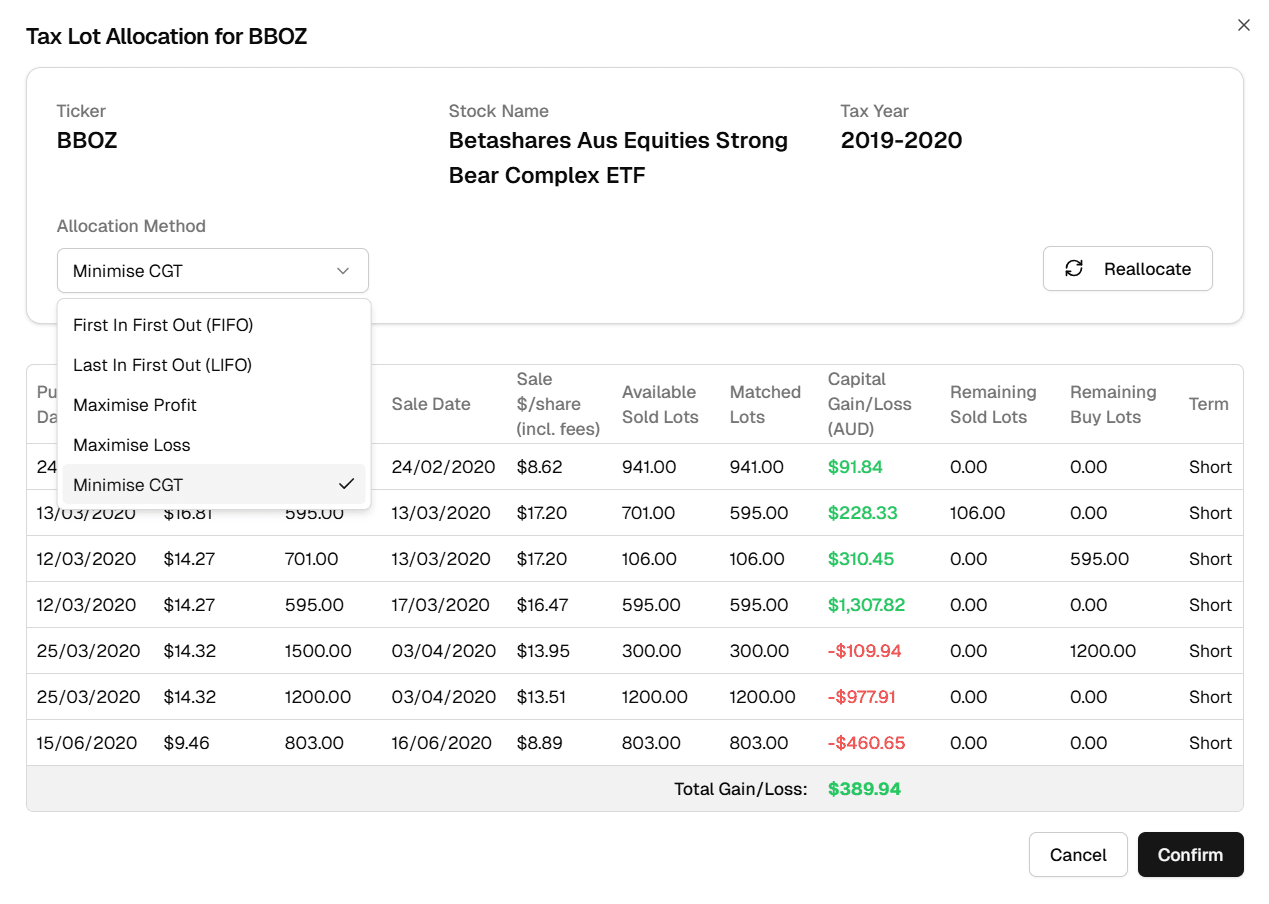

For standard shares, the CGT rules are direct. The key is meticulous tracking of each buy and sell transaction to manage your parcels correctly. This allows you to use allocation methods like FIFO (First-In, First-Out) or strategically choose specific parcels to sell.

ETFs and Managed Funds

ETFs are typically structured as trusts. This means that in addition to any capital gain you make from selling your ETF units, the fund itself may generate capital gains internally from its own trading activities. These gains are distributed to you, the unitholder, each year.

You will receive an annual tax statement (often called an AMMA statement) detailing these distributed capital gains, which you must include in your tax return.

Foreign Stocks

Investing overseas introduces currency fluctuations into the CGT calculation. The ATO requires all figures to be converted to Australian dollars (AUD).

- Cost Base: The AUD value of your investment is calculated on the day you bought it.

- Capital Proceeds: The AUD value is calculated on the day you sold it.

This means your final capital gain or loss is affected by both the asset's performance and the exchange rate's movement. If you paid foreign tax on your gains, you might be eligible for a Foreign Income Tax Offset (FITO) to avoid double taxation.

The CGT Discount

If you are an individual and hold a CGT asset for more than 12 months before selling it, you are generally entitled to a 50% discount on the capital gain. This means only half of the gain is added to your assessable income. This is one of the most significant concessions in the Australian tax system for investors.

From Complexity to Clarity: How taxtallee Helps

Keeping track of every parcel, calculating cost bases in different currencies, and applying the correct discounts can quickly become overwhelming. That's where taxtallee comes in.

We built our platform from the ground up to solve these exact challenges for Australian investors.

- Automated Record-Keeping: Simply upload your trades, and we'll handle the complex lot tracking for you.

- Strategic Allocation: Go beyond simple FIFO. With taxtallee, you can model and apply different allocation methods (like LIFO, Maximise Loss, or Minimise CGT) to see which gives you the best tax outcome.

- Handles Complexity: Our system seamlessly manages foreign currency conversions and helps you account for ETF distributions.

- Tax-Ready Reports: Generate a comprehensive Capital Gains Tax report at the click of a button, ready for you or your accountant to use for your tax return.

Don't let the complexity of CGT hold you back. Take control of your investments and your tax outcomes.